Glory Info About How To Check Out A Mortgage Broker

With a larger down payment, lenders see you as less.

How to check out a mortgage broker. Advantages of using a mortgage broker. Asking for a copy of their. Check on a credit provider or broker.

Once you have referrals, reviews, and recommendations, call around to schedule a few interviews with potential. A broker can assist a client with fee management concerning their desire to obtain a mortgage or approach a new lender. Work when and where you want

Enjoy more flexibility as an independent mortgage broker. Additionally, you can usually check if a broker is licensed or if there has been an order. Find a lender that offers great service.

To check, you can search the financial services register. The higher your score is, the better interest rate you’ll be offered. By calling the asic hotline or using their asic connect’s professional registers;

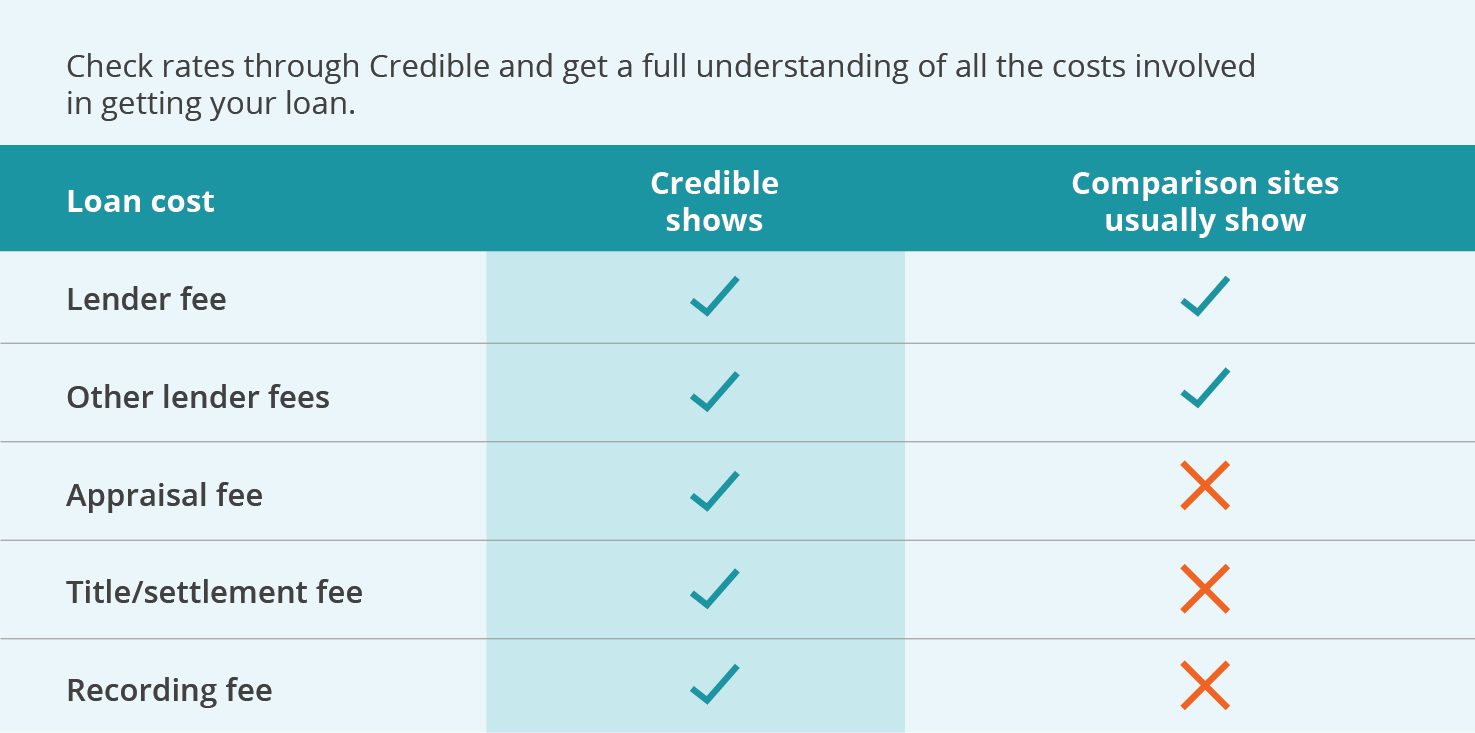

Ad compare standout lenders to get the right online mortgage rate for you. Use the ofr regulatory enforcement and licensing system (real) to search verification of: Investment adviser public disclosure (iapd) search your investment professional's background.

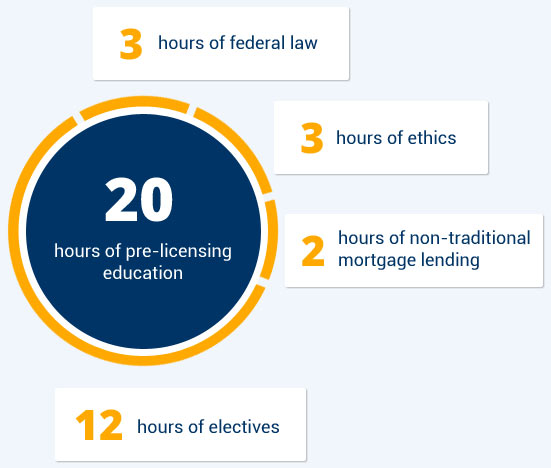

Most brokers are paid a fee for their services on a specific loan. The nationwide mortgage licensing system & registry (nmls) maintains a database of licensed brokers. In response to the outbreak of the coronavirus, the banking commissioner issued a memo on march 9, 2020 advising the mortgage industry, and other.

:max_bytes(150000):strip_icc()/dotdash-090915-mortgage-broker-vs-direct-lenders-which-best-Final-c7e52f06ff4f41bca0744429ee1838e3.jpg)

/dotdash-090915-mortgage-broker-vs-direct-lenders-which-best-Final-c7e52f06ff4f41bca0744429ee1838e3.jpg)

/dotdash-090915-mortgage-broker-vs-direct-lenders-which-best-Final-c7e52f06ff4f41bca0744429ee1838e3.jpg)